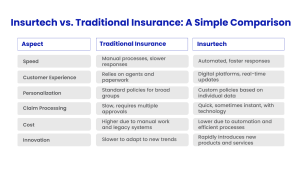

The insurance industry is undergoing a significant transformation as technology reshapes how services are delivered.

Insurtech, which stands for insurance technology, uses modern tools to improve and simplify traditional insurance processes. It involves innovations like automating tasks, analyzing data for better decisions, and offering easy-to-use digital platforms for customers.

Insurtech aims to make insurance faster, cheaper, and more personalized, responding to the growing demand for a smoother customer experience.

Core Elements of Insurtech

1. Automation and Efficiency

Insurtech is changing how insurance companies operate by using technology to perform tasks that once required human effort. For example, claims processing (when someone reports damage or loss) or underwriting (when an insurer determines risk and coverage) can now be done automatically, speeding up the time it takes to get a response.

2. Data-Driven Personalization

Insurtech uses data to create personalized insurance products. For instance, car insurance can now be based on your actual driving habits instead of generalized assumptions, making policies more tailored to individual behavior.

3. Customer-Centric Platforms

Instead of relying on insurance agents, Insurtech platforms allow customers to buy, manage, and claim insurance policies directly online or through mobile apps. This puts more control in the hands of consumers, offering convenience and transparency.

4. Product Innovation

Insurtech is behind new types of insurance products that fit modern lifestyles:

- On-demand insurance offers short-term coverage when needed (e.g., travel insurance for just one trip).

- Peer-to-peer insurance (P2P) allows groups to pool their money to cover each other’s claims, bypassing traditional insurance structures.

- Micro-insurance offers small-scale coverage for specific needs, making it accessible to lower-income populations.

Benefits of Insurtech

- Cost Savings: Insurtech reduces costs by automating routine tasks, which lowers the need for expensive human labor.

- Tailored Services: With better data, Insurtech companies can offer personalized products that meet individual needs, like adjusting your premium based on how safely you drive.

- Faster Services: Insurtech platforms can process claims and offer quotes much faster than traditional insurers, often providing real-time services through apps.

- Risk Reduction: By analyzing large amounts of data, Insurtech companies can better predict and manage risks, making their products more reliable.

Insurtech in Saudi Arabia: Growth and Opportunity

In Saudi Arabia, Insurtech is playing an increasingly important role as the country aims to diversify its economy under Vision 2030. The government’s push for digitalization across industries has created new opportunities for Insurtech companies to thrive.

Saudi Arabia’s insurance sector is growing rapidly, with health and motor insurance leading the charge.

Market Growth

Saudi Arabia’s insurance market is expected to grow to SR68.3 billion by the end of 2024. This growth is driven by innovations in health insurance, which accounts for the largest share, and motor insurance, which is boosted by new regulations and rising demand for digital products.

Key Trends in Saudi Arabia

- Health and Motor Insurance: Health insurance makes up a significant portion of the market, driven by increasing demand and the high cost of healthcare. Motor insurance is also growing quickly, thanks to new regulations and the development of telematics-based insurance models (insurance that adjusts based on how safely you drive).

- Shariah-Compliant Insurance (Takaful): Many Saudi consumers prefer Takaful, a type of insurance that complies with Islamic principles. Insurtech is making it easier to buy and manage Takaful policies online, bringing transparency and ease to the process.

- On-Demand Insurance: Younger consumers and gig economy workers are driving demand for flexible insurance products like on-demand insurance, which allows people to purchase coverage for specific events or periods.

The Role of Vision 2030

Saudi Arabia’s Vision 2030 plan aims to diversify the economy and increase financial inclusion. This includes modernizing the insurance industry through digital tools and innovation.

The government’s support for Insurtech is helping the sector grow, with the Saudi Arabian Monetary Authority (SAMA) offering a Regulatory Sandbox that allows Insurtech companies to test new products while ensuring they meet local regulations.

Conclusion:

Insurtech is transforming the global insurance industry by introducing faster, more personalized, and user-friendly solutions. In Saudi Arabia, the combination of government support, consumer demand, and innovative technologies is driving rapid growth in the sector.

As Insurtech companies continue to innovate, the insurance landscape will become more customer-focused, efficient, and accessible to everyone.

While challenges remain, the future of Insurtech looks promising, with more collaboration expected between traditional insurers and tech-driven startups to meet the needs of modern consumers.

Resource List

- Mordor Intelligence: Middle East and Africa Insurtech Market

Read the full report on Mordor Intelligence - Arab News: Saudi Arabia’s Insurtech Market Growth

Read the article on Arab News - PwC: Fintech and Insurance Report

Download the PwC report - Fintech Saudi: Insurtech Market in Saudi Arabia

Access the report on Fintech Saudi - Deloitte: Fintech and Insurtech Investment Trends

Explore the Deloitte insights - Misk Hub: Insurtech Market Size in Saudi Arabia

Read more on Misk Hub